September/October 2017 – BizVoice/Indiana Chamber

29

Close to home

Venture capital investing is often a

hands-on endeavor, which is why many firms

want to be in drivable proximity.

“We won’t just hand over a check and

be passive,” Cramer affirms. “We take a

board seat or (serve as a) board observer on

every deal we do because we want to help.

We want to be able to open up our Rolodex

if they’re looking for a VP of sales or CTO

(chief technology officer) and we can help

them find quality talent. From a business

development standpoint, if they’re trying to

sell into a large company in Grand Rapids or

Detroit, or we have (connections in many

companies throughout the country), we view

our investments as a partnership.”

Barry concurs.

“We want to be able to get a call from a

CEO at 2 p.m. who wants us to be at

interviews on a moment’s notice,” he says.

Investing in the Midwest also begets a

consideration of scale.

“We also like the Series A stage because

it’s not like a $20 to $40 million Series A on

the coast,” Cramer reveals. “It’s a $3 to $5

million Series A round here in the Midwest.

It allows us to make sure we can get our

ownership targets that we try to get internally,

but also to get other great co-investors here

in the Midwest.”

He adds that working relationships with

other quality firms build a rising tide in the

region.

“In the Midwest, it’s a more

collaborative nature,” Cramer offers. “It’s not

a sharp elbows approach where people are

trying to box each other out. We all see the

10- to 30-year vision.”

To the ‘Next Level’

The Next Level Indiana Fund, which was

approved by the Legislature in 2017 and

modernizes the Next Generation Trust Fund,

will allow the state to invest in higher-risk

opportunities via venture capital firms. The

fund’s potential pool is $250 million, and

out-of-state firms with a record of supporting

Hoosier businesses are eligible.

“It’s smart they invest alongside funds …

the No. 1 criteria for successful investing is a

disciplined, due diligence process,” True notes.

Barry shares True’s enthusiasm for the

program, recalling a similar effort in Michigan.

“We saw what (Venture Michigan Funds

I and II) did for the technology and VC ecosystem

in Michigan,” he relays. “It was incredible. When

they started those funds, there was a very

small tech and VC scene in Michigan with a

lot of gaps in types of financing. ... I used to

say good deals didn’t always get funded in

Michigan. But now, if a good deal is looking

for funding, it will get funded. I attribute

almost all of this to the success of those funds.”

Barry adds that these programs haven’t

succeeded in all states in which they’ve been

tried, but reiterates his excitement to see it

happen in Indiana.

Bumps in the crossroad?

When asked about challenges in

investing in Indiana, those interviewed had

few reservations.

“I’d say the top challenge in Indy is, as a

general rule, getting larger funds to come and

help scale-up companies,” True offers. “I

think the East Coast funds are more apt to

invest in Indianapolis because the West Coast

funds like to invest close to home. It takes a

unique entrepreneur or unique relationships

with board members to get the VC firms

there.”

He offers optimism, however, noting

some larger funds are putting offices in

Indiana to build a long-term pipeline.

“There is such a profound shortage of

equity rounds here of $1 (million) to $3

million, and there are only a dozen funds

actively able to write checks big enough to fill

those rounds in the Midwest,” Cramer adds.

While the tech scene in Indianapolis

remains a focal point, it’s not the only city in

the state that’s drawing attention. Cramer

notes that Grand Ventures has met with

companies in Fort Wayne.

Plymouth Group is also exploring

beyond the state capital.

“Most of the companies we’re looking at

are in Indianapolis,” Barry concludes, adding,

“I don’t want to show my cards too much,

but we are actively looking at companies in

other parts of the state.”

RESOURCES:

Jeff Barry, Plymouth Growth Partners, at

www.plymouthgp.com| Maitlan Cramer, Grand Ventures, at

www.grandvcp.com| John True,

Cultivation Capital, at

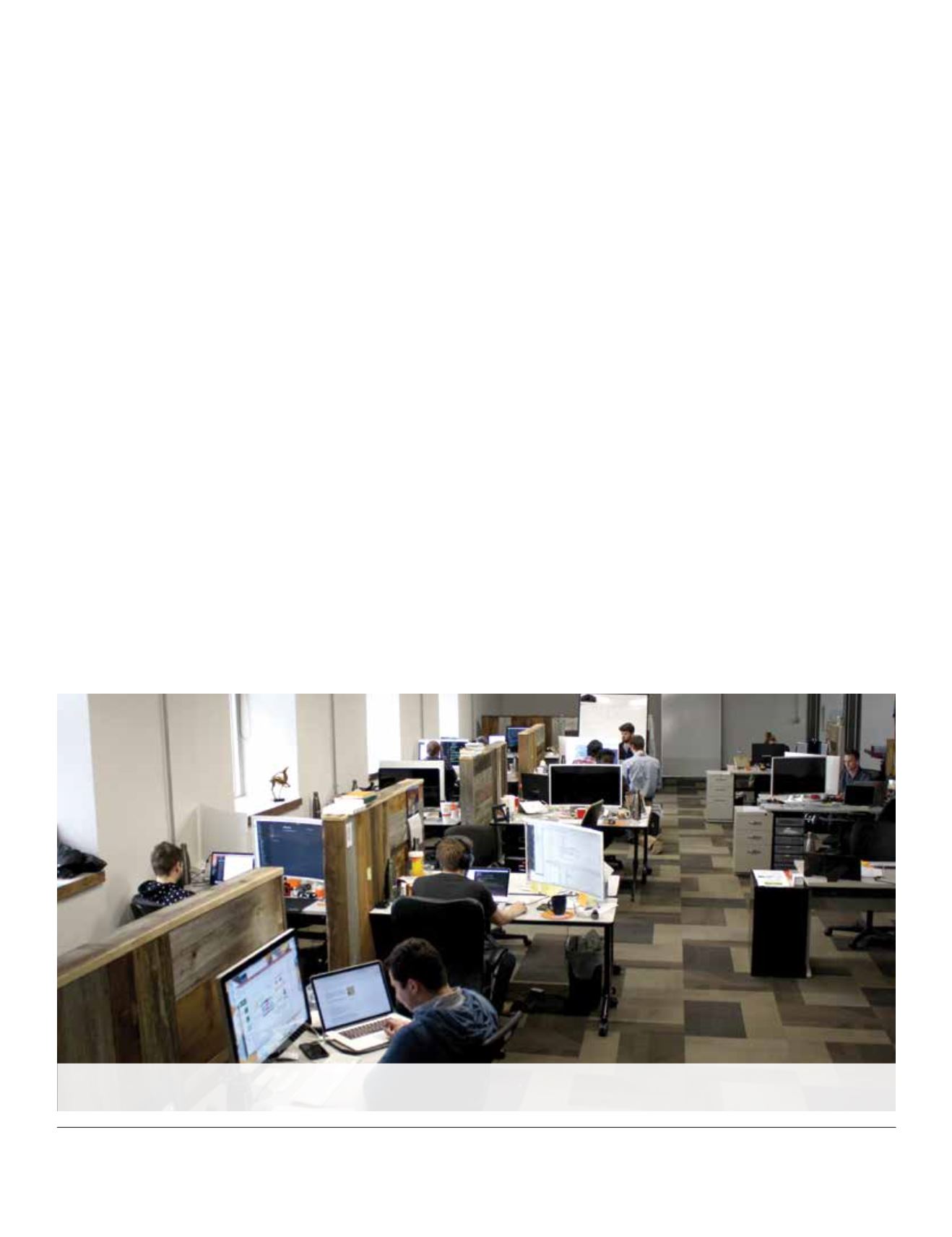

www.cultivationcapital.comSpringbuk, one of the first companies to move into The Union 525 space in downtown Indianapolis, is among the beneficiaries of out-of-state venture

capital with an investment from Lewis & Clark Ventures in St. Louis.