54

BizVoice/Indiana Chamber – September/October 2017

YOUR TIME IS VALUABLE.

Maximize it with our

business

services.

Services include treasury

management, business consulting,

and benefit packages.

CALL |

317.558.6299 or 800.382.5414

CLICK |

forumcu.comVISIT |

any FORUM branch

plan, where an extra percentage of your pay

is deposited into (your) 401(k) account. It

does offer a breadth of flexibility of different

benefits that can appeal to any sort of

generation here.”

Roche has over 95% participation in its

401(k) plan.

Planning ahead

Medical is a key piece of Roche’s

retirement offerings.

“Once you reach, say age 65, and you’re

on Medicare, we have two different kinds of

accounts,” Embry comments. “One that can

either pay a portion of your Medicare supplement

or another one that’s more cash based.

Depending on how many years you’ve been

here, you’ll earn money into that account and

you can use that in any way (you desire). But

the fact that we still provide that – that’s not

really the trend today. More companies are

really cutting back on that. But we feel it’s a

valuable benefit to offer to our employees.”

Foley points to the long-term care area

as one of OneAmerica’s fastest-growing

segments.

“We’re fortunate in that we have a very

unique product line and one that allows

people to cover potential needs in the long-

term care area on an unlimited basis with a

guaranteed cost structure or a guaranteed

premium,” he notes.

Boyle sheds light on how Roche is able

to continue providing competitive retirement

benefits.

“We just make it a priority,” she emphasizes.

“We definitely have to make tough decisions

around our health plans in general for our

active employees and our retirees. And we

re-evaluate that every year to say, ‘What are

the costs of health care and how are we

managing the costs while still being highly

competitive?’ We’ve made a commitment

that we want to take care of our employees

and we want to have high engagement …”

Carmichael’s voice is heavy with pride as

he describes Weddle’s success as an ESOP,

which he terms “a game changer.”

“Since the inception of the ESOP, our

shares have increased, on average, over 100%

each year. That trend can’t continue forever,

but it’s been a great trend.”

RESOURCES:

Bridget Boyle and Judy Embry, Roche Diagnostics, at

www.roche.com| Lee Carmichael, Weddle Bros. Construction, at

www.weddlebros.com|

Doug Prince, ProCourse Fiduciary Advisors, at

www.procourseadv.com| Pat Foley, OneAmerica Financial Partners, at

www.oneamerica.com“The biggest question is, ‘Why do we

have this retirement plan? What do

we want to use the retirement plan to

help us achieve as an organization

and how can the plan do that?’ ”

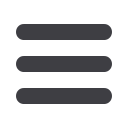

Doug Prince, chief executive officer

ProCourse Fiduciary Advisors