96

BizVoice/Indiana Chamber – November/December 2017

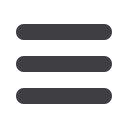

STATE TAX COMPARISONS

FOUND ELSEWHERE

Sources: Tax Foundation calculations using Census Bureau, State and Local Government Finance, and Federal Highway Administration data.

The most recent data

for how state roads

are funded is from

fiscal year 2014. Yet,

it’s always interesting

to view the numbers

for all the states.

Expect to see some

changes in Indiana in

coming years as a

result of the long-

term transportation

funding plan passed

in the 2017 Indiana

General Assembly

session.

VA

37.0%

#43

NC

63.2%

#8

SC

59.7%

#12

GA

39.6%

#39

FL

67.8%

#4

AL

37.4%

#42

MS

36.2%

#44

TN 52.5%

#21

KY

39.9%

#38

OH

55.5%

#16

IN

43.2%

#31

IL

54.7%

#19

MO

41.6%

#33

AR

37.8%

#41

LA

32.9%

#45

IA

42.8%

#32

MN

41.2%

#36

WI

40.7%

#37

MI

62.1%

#9

PA

50.8%

#23

NY

68.5%

#3

ME

55.3%

#18

TX

58.9%

#13

OK

60.8%

#11

KS

44.1%

#30

NE

45.1%

#27

SD

25.5%

#48

ND

22.8%

#49

MT

38.1%

#40

WY

29.0%

#46

CO

49.9%

#24

NM

41.5%

#35

AZ

51.4%

#22

UT

55.4%

#17

NV

56.6%

#14

ID

47.8%

#26

OR

64.3%

#7

WA

54.2%

#20

CA

61.8%

#10

AK

12.0%

#50

HI

76.3%

#1

WV

45.0%

#28

MA: 56.0% (#15)

RI: 41.6% (#34)

CT: 44.9% (#29)

NJ: 67.2% (#5)

DE: 69.1% (#2)

MD: 66.9% (#6)

DC: 27.6% (#46)

VT: 26.0% (#47)

NH: 48.9% (#25)

How Are Your State’s Roads Funded?

Share of State and Local Road Spending Covered by State and Local Tolls, User Fees and User Taxes, FY 2014

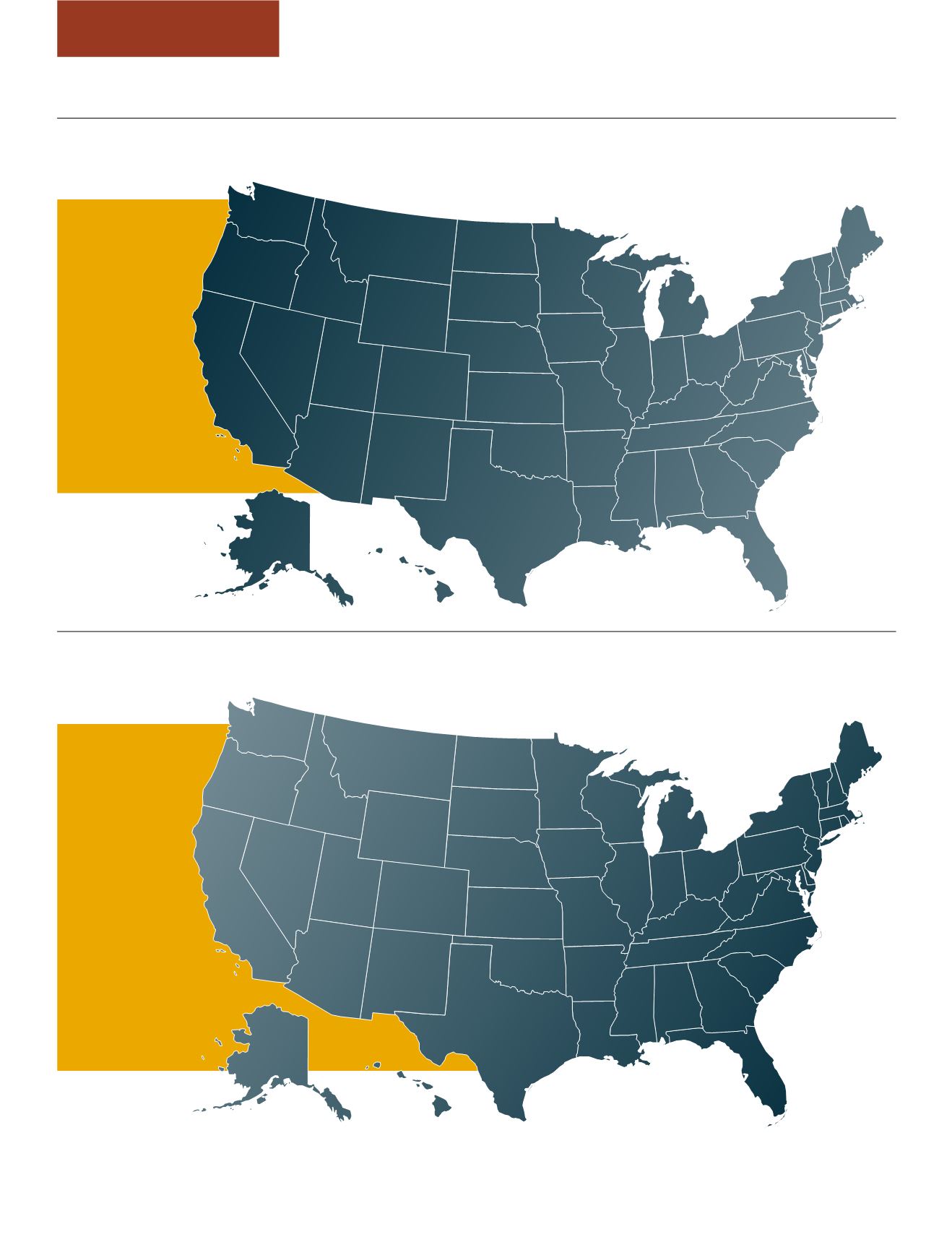

How Much Does Your State Collect in Sales Tax Per Capita?

State General Sales Tax Collections per Capita, FY 2015

In the world of sales

taxes, not all states are

directly comparable.

Alaska, Delaware,

Montana, New

Hampshire and

Oregon are the five

states with no sales

tax. Hawaii, New

Mexico and South

Dakota have broad

bases that include

many services. Some

states levy gross receipts

taxes in addition to

sales taxes, which the

Census Bureau

includes in sales tax

collection data.

VA

$452

#45

NC

$683

#36

SC

$729

#32

GA

$515

#43

FL

$1,075

#12

AL

$507

#44

MS

$1,144

#7

TN

$992 #18

KY

$738

#30

OH

$1,025

#15

IN

$1,100

#10

IL

$696

#34

MO

$556

#41

AR

$1,069

#13

LA

$627 #39

IA

$973

#20

MN

$999

#17

WI

$848

#28

MI

$928

#24

PA

$771

#29

NY

$662

#37

ME

$963

#21

TX

$1,226

#6

OK

$686

#35

KS

$1,049

#14

NE

$943

#23

SD*

$1,131

#9

ND

$1,835

#2

MT

n/a

WY

$1,384

#5

CO

$516

#42

NM*

$1,082

#11

AZ

$947

#22

UT

$628

#38

NV

$1,412

#4

ID

$885

#26

OR

n/a

WA

$1,746

#3

CA

$983

#19

AK

n/a

HI*

$2,090

#1

WV

$701

#33

MA: $854 (#27)

RI: $908 (#25)

CT: $1,137 (#8)

NJ: $1,021 (#16)

DE: (n/a)

MD: $734 (#31)

DC: (n/a)

VT: $586 (#40)

NH: (n/a)